Insolvency Data Processing

A Guide for Insurance IT Professionals

This guide is intended to provide a basic understanding of data processing roles and responsibilities for those working with insolvent property/casualty company claims data. It includes a description of the four phases of an insolvency data conversion project, ongoing responsibilities for data transmission, a glossary of terms, and links to various resources to help ensure successful data transfer when an insolvency occurs.

Overview

The Liquidation Process: Claims Data Perspective

Phase I: Evaluation

Policy-related UDS Records from the Insolvent Company or its Receiver

Phase II: Extraction

Phase III: Processing

Phase IV: Production

After the Initial UDS Transmission: Ongoing Responsibilities

Getting Help

Additional Information

Glossary of Terms

Data Roles and Responsibilities

Frequently Asked Questions

Change Log

Overview

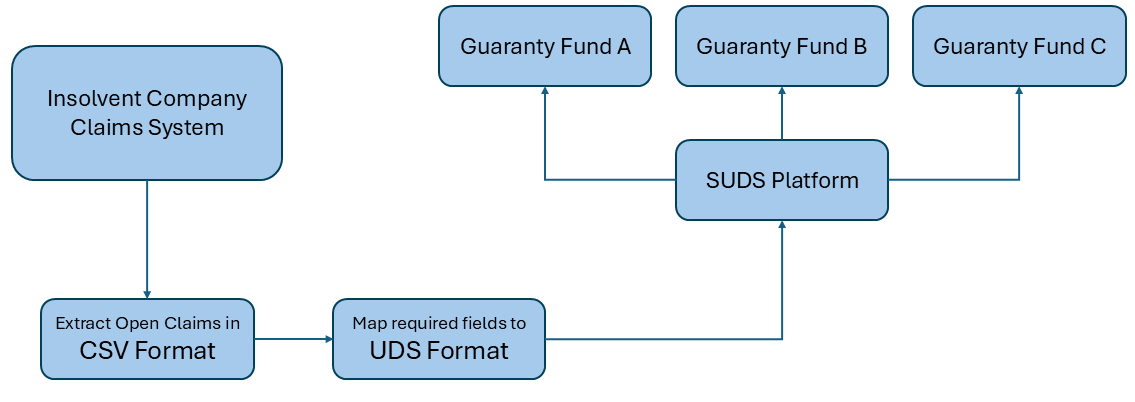

State insurance guaranty funds, together with the receivership community, developed the Uniform Data Standard (UDS) for property/casualty claims data transfer in the late 1980’s. This standard defines nine fixed-length file formats widely used within this space. The objectives for processing claims data post-insolvency are simple: extract open claims data from the insolvent company’s system(s), convert it into the UDS standard format, and move it securely to the correct state guaranty fund(s) as quickly as possible.

- Transforming data from an insolvent company’s claim system into a common format easily imported into guaranty fund claims systems greatly speeds up the data transfer process. This is the purpose of the UDS file formats.

- Moving accurate data to the guaranty funds as quickly as possible is critical in an insolvency so that the guaranty funds can begin making payments to impacted claimants. This is facilitated by enforcing the structure and validation rules of UDS.

The Liquidation Process: Claims Data Perspective

The desired outcome of an insolvent company’s liquidation is to protect the company’s policyholders and have as little impact as possible on the claimants. What does this look like from a data processing perspective, ideally?

Ideal…

Once a company is placed in liquidation, the insolvent company ceases to handle existing claims, and the state guaranty funds begin handling them. All relevant claims data is extracted from the insolvent company’s systems as rapidly as possible, transformed into Uniform Data Standard (UDS) compliant files, and sent to each state guaranty fund on the date of liquidation.

Reality…

Data extraction, particularly of documents and images from document management systems, can be time-consuming and may be a task that the insolvent company staff has never attempted. The process can be slow, and possibly expensive depending on the system(s) involved.

Insolvency Data Management Best Practices

The optimal solution is to divide the process into four general phase:

Each of these phases may be revisited multiple times during the course of an insolvency. For example, if a company handles workers’ compensation and general liability claims, the workers’ compensation claims may be fully transitioned to the guaranty funds first (phases I through IV), followed by the general liability claims. Likewise, there will be the initial processing and sending of open claims (all types, sequentially), and later, the new claim and re-opening process will start.

This guide focuses primarily on the Evaluation phase, which is ideally completed pre-liquidation, with the remaining steps taken in the first days after liquidation.

Phase I: Evaluation

Evaluation starts with learning what data is required by the guaranty funds and evaluating the insolvent company’s data, considering the requirements.

Claim-Related UDS Records from the Insolvent Company or its Receiver

The UDS Manual provides the field-level details for each of the UDS record types. Below is a high-level overview of each UDS record type, and how they collectively ensure the success of the insolvency claim transfer process.

Which Claims to Transfer?

The guaranty funds will need all OPEN claims and their associated policies. Closed claims are not relevant to the guaranty funds until one or more of them need to be re-opened.

After the initial data is extracted, processed, and transmitted, an ongoing process can be developed for extracting, processing, and transmitting re-opened claims. The process for transmitting data needed for re-opened claims can be modeled after that developed for the universe of open claims at the time of liquidation.

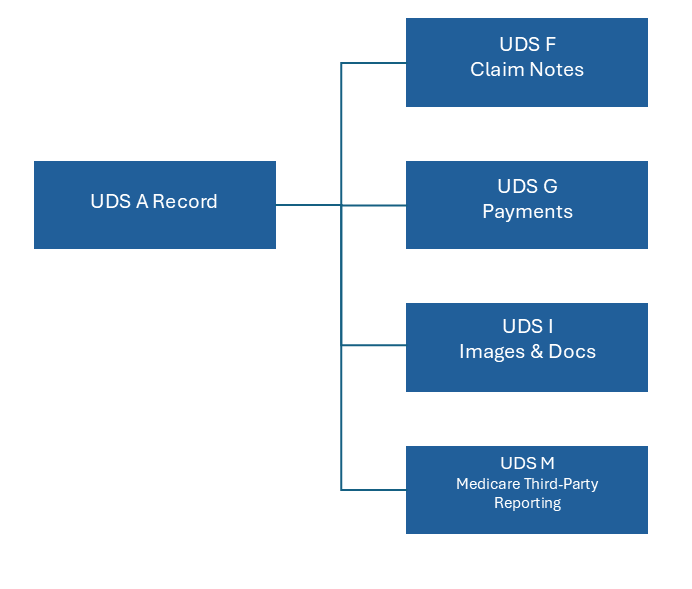

The UDS A Record (Open Loss Claims)

The UDS A record is the foundational or parent record on which other types of UDS records (F/G/I/M) depend. It includes the NAIC number of the insolvent company, the policy’s most important information, the claim number, and the date of loss. It also includes each claimant on the claim and each policy coverage against which the claimant is making a claim.

Uniqueness

Each UDS A record, within a given file and across all the A records of the insolvency, must apply to a single insolvency, a single claim number, and a single claimant + coverage for the claimant.

A claim may have multiple claimants, but each must be associated with a unique coverage. Likewise, a single claimant may have a claim against more than one coverage. Thus, a personal auto claim may have three bodily injury claimants, and one claimant may have a bodily injury claim and a property damage claim but not two bodily injury claims for a single person.

The final A record file transmitted to a guaranty fund will have one row per claim – claimant – coverage combination.

Reserves

UDS requires the current outstanding Loss Reserve to be provided for each claim-claimant-coverage combination and to use the “100” transaction code. When transmitting a closed claimant-coverage, the outstanding loss reserve should be zero. Expense Reserves should not be provided. If the source system combines Loss and Expense reserves, the total should be provided as the outstanding Loss Reserve. This information aims to help the state guaranty funds quickly assess the insolvent company’s position as to its financial exposure.

If two policies apply to the same claim (e.g., a primary and an excess policy), separating them into two claims is recommended. Guaranty fund claim systems may track policy limit erosion, necessitating separate claims.

Caution Regarding Claimant Numbers

If the source system associates one person with multiple claimant numbers, it is best not to use claimant numbers from the source. Instead, they should be re-numbered so that one person is associated with one claimant number.

Child Records of the A Record

The UDS F (Claim Notes), G (Payments), I (Images & Documents), and M (Medicare Third-Party Reporting) records must each be associated with a single row of the A record. They must match the insolvent company’s NAIC number, policy number, claim number, claimant number, and coverage code. If F, G, I or M records have no matching A record parent(s), there is an error in the parent or child record preparation.

UDS F: Claim Notes

Notes made by adjusters and other claim professionals, as well as system-generated text on the claim’s progress, are exported from the source system and converted to UDS F records. The UDS 2.1 format (current) does not support drawings or HTML references to system documents.

Caution: If the source system associates Notes at the claim level rather than the claimant level, all Notes should be linked to the lowest (first) claimant number. However, if Notes are linked at the claimant level, they should be handled similarly in the F record.

UDS G: Claim Payment History

Payments made by the insolvent company or others on its behalf are exported and converted into UDS G records. If Loss Adjustment Expenses are paid at a claim level (rather than claim/claimant/coverage), link all Loss Adjustment Expense payments with the lowest numbered (first) claimant and coverage. A numbering convention should be created if payments are made electronically and check numbers are not available, nor are other ID numbers for those payments.

If payments are voided, it is best to include both the original transaction and the reversal as separate transactions.

UDS I: Images/Documents

Correspondence, reports, images, videos, audio recordings, etc., are exported as UDS I records. A full copy of the policy or, at minimum, the declaration pages for the policy should be included in these files. At transmittal, there should be a .zip file of the individual files (images, recordings, etc. and the I record file, which is an index to the files themselves. Each row associates a file identified by name and path with a claim, claimant, etc., and gives the folder type (e.g., broad category such as Legal or Medical) and a Document Type (e.g., correspondence, medical bill).

Transferring Non-UDS Data

If data needed by the guaranty funds exists but would lose fidelity when exported to UDS (such as a highly formatted notes system with drawings and embedded video or audio), or if the data simply does not fit into the UDS standard for some other reason, alternative formats and transfer methods can be used. For example, if Notes were put in a searchable PDF and identifiers added so the embedded files could be found as an I record, the PDF could be sent as an I record.

If no other transfer is possible, the UDS Data Mapper also allows for transferring files directly via Secure UDS (SUDS). If a more custom solution is needed, contact GSI for additional options.

UDS E: Closed Claims, and UDS M: Medicare Third-Party Reporting

These files are rarely transmitted during an insolvency. They should be sent after all UDS A, F, G, I, and B records are complete. They are covered in more detail below.

Policy-related UDS Records from the Insolvent Company or its Receiver

UDS B Records: Return Premium (aka Unearned Premium or “UEP”)

UDS B records consist of a single row per policy and inform the fund of that part of the premium the insured paid but was not earned by the company because the policy was canceled by the court order and state law, or by the Insured. The UDS B record is typically transmitted when the amount due to the insured is known, and the ‘815’ transaction code is used. If after the 815 is transmitted, the amount changes (for example, the insured shows proof they replaced the policy earlier than the cancellation date), the additional amount to be refunded is transmitted with the 835 transaction code.

Terminology in this area varies, so it is wise for the insolvent company, the receiver, and the guaranty funds to confirm understanding through detailed discussions before UDS B records are generated.

Missing Data Fields in the Source

Inevitably, source data will contain fields whose use is not clearly understood, and will be missing some required or desired data fields. Consult the Extended Descriptions sections of the UDS Manual for each record type for more about the meaning of the fields, whether they are required, and acceptable default values to be used when the data is unavailable.

Additional information is available on the GSI website and by contacting GSI Support.

Phase II: Extraction

The insolvent company’s IT staff (if available) are usually the best resource for advising or extracting data from the insolvent company’s system.

In cases where the original staff is no longer available, or the claims system vendor does not allow the customer to extract data themselves, engaging the software vendor or another professional firm may be required. GSI has experience with extracting data from various claims systems and may be able to assist, if desired.

A common pitfall is to focus exclusively on extracting data needed for the UDS A record, when data for the other UDS record types could be extracted in parallel work streams. Time is of the essence in an insolvency: file preparation for one UDS type need not be delayed if other work can proceed.

Phase III: Processing

Inevitably, there will be at least minor data cleansing action needed. Examples include:

- Shortening names or addresses to fit into fixed-length UDS fields

- Eliminating duplicate records

- Removing nonconforming characters or null rows

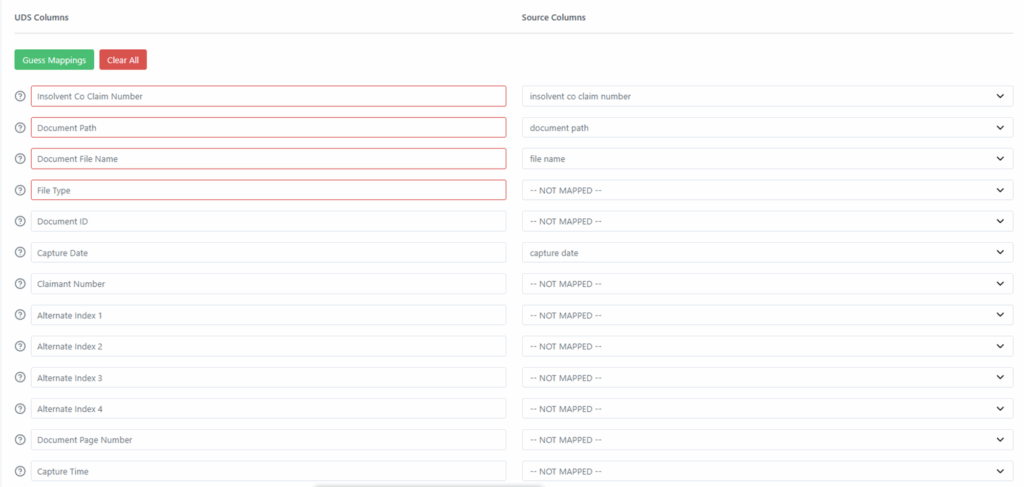

The UDS Data Mapper, owned by NCIGF and maintained by GSI, can perform many of these cleansing tasks automatically.

UDS Data Mapper

GSI operates a free online tool to assist with transforming claims systems data from various formats into the required UDS standard. The UDS Data Mapper eases the creation and transfer process of UDS and eliminates the need to learn the details of intricate fixed-length UDS rows. The UDS Data Mapper is a web-based application that allows receivers to quickly and easily create UDS records from Comma Separated Values (CSV) files for distribution to the guaranty funds. The Data Mapper will automatically create the necessary header and trailer records and supply several UDS defaults.

The UDS Data Mapper can also evaluate whether existing files comply with UDS standards before sending it to the guaranty funds.

Access to the UDS Data Mapper is free for authorized users. GSI also offers Secure Cloud Storage options for insolvent company data. For more information, please visit the GSI website or contact GSI Support.

Phase IV: Production

Transmission of UDS-formatted data to the guaranty funds is typically done through the Secure UDS Transfer platform (“SUDS” for short).

Secure UDS Transfer (SUDS)

SUDS is a secure cloud storage space GSI provides to simplify document transfer between GSI, insolvent companies, guaranty funds, and receivers. SUDS can be used by receivers to transmit records to guaranty funds, and by guaranty funds to transmit UDS C and UDS D records to the receivers. SUDS is available free of charge for use by the IT staff of insolvent companies, receivers, and guaranty funds. Contact GSI Support to request a SUDS account. More information about SUDS is available here.

Rejected UDS files

Occasionally, a guaranty fund may reject one or more UDS files because they are not UDS compliant. GSI can help in these situations, particularly if the file’s compliance is questioned.

Data Security

Care must be taken to follow relevant data security and privacy policies, with particular attention given to securing Personally Identifiable Information (PII) and Personal Health Information (PHI). Data in transit must always be transferred securely. Using the Secure File Transfer Protocol (SFTP) service with public-key cryptography, SUDS provides such a secure transfer mechanism.

Data Retention

To minimize cyber risk while still meeting the needs of the insolvency community, GSI has implemented comprehensive retention policies for data stored in the secure GSI cloud environment.

Data in the UDS Data Mapper is kept for one year after a claim has been accessed. If no new A, F, G, or I records have been created for a specific claim number in over a year, all data for that claim number will be deleted. See UDS Data Mapper Retention Policy for more information.

The primary use of SUDS is data transfer, not storage. Files uploaded to SUDS are deleted automatically 30 days after creation. GSI offers Secure Cloud Storage options for receivers in need of longer-term storage. Example scenario: A receiver is setting up a new document management system and will need the I records (images) later, but the new system won’t be up and running within 30 days.

After the Initial UDS Transmission: Ongoing Responsibilities

There will typically be both newly reported and re-opened claims for the insolvent company. The data requirements for these two cases are slightly different. The line of business, the age of the insolvent company, and its claim-handling practices can each impact the number of claims and the rate at which these requests are made. It is advised to set expectations with the guaranty funds on how frequently these UDS records will be created and sent to them. Sending the files twice a week for the first month, then weekly for the next six months, and then sending bi-weekly is a good practice. Contact the impacted guaranty funds for guidance on specific insolvencies and their transmission frequency preferences.

Newly Reported Claims

It is understood within the insurance business that not all claims are reported as soon as they are incurred. New claim reports received after the insolvency date may go to the state guaranty fund, the receiver, the insolvent company, or some combination of these. Receivers often set up all these claims and send them from the insolvent company’s system, which facilitates loading the payments and taking other actions on the claims by the state guaranty funds.

In such a scenario, there will be UDS A records and, at most, one or two accompanying UDS I records to send to the guaranty fund.

Re-opening of Closed Claims

Claims may be re-opened because a party feels the original adjuster missed handling an issue or simply because the claimant sees a chance to get a second look at the claim. However, the guaranty funds can only act on the claim once the file is sent to them. Due to size limitations and security constraints, previously closed claims are typically not transmitted in bulk at the time of insolvency.

If a claim re-opens, the UDS A records for all claimants and coverages and the full F, G, and I records must be sent to the guaranty fund(s). When the receiver or insolvent company staff processes a request to re-open a claim, it is helpful to document the reason for re-opening in a note in the UDS F records. If the need to re-open the claim was documented in a written request, that document must be included as an I record for the claim.

Some receivers hire GSI to assist with the re-open process. This works well, but the reason for re-opening must be properly documented in the source system before GSI is asked to generate UDS records for a re-opened claim. For this process to work, GSI must have access to the source system on an ongoing basis, or obtain a complete data extraction of all policy and claim files.

Receivers Receipt and Processing of Information Coming Back from the Funds

Some receivers may need the staff of the insolvent insurance company to take on the continuing obligation to process the information and payments being submitted to the receiver by the state guaranty funds. This is often because the insolvent company has significant reinsurance receivables, and the company’s system handles that process well.

The information transmitted from the guaranty funds to the receiver is sent via UDS C records and UDS D records. Because this task will be outside the scope of those working on the data initially for many, it is covered in more detail below.

Getting Help

For additional help with UDS and insolvency data processing, please consult the UDS Manual, the GSI website, or contact GSI Support.

Additional Information

UDS C Records: Detail Claims Transactions

UDS C records are usually submitted monthly by the guaranty funds but can be submitted quarterly if the receiver requests a transaction-level file containing all payments and recoveries since the prior file. This detailed data includes payee information, check numbers, and amounts. The file also contains the current outstanding loss and expense reserves at the claimant-coverage level for every open line. Any new claims added to the system or closed claims are also included in the file. Different types of transactions are distinguished from one another by transaction codes, which are described in detail in the UDS Manual.

The method by which these records are loaded into the insolvent company’s system will vary, but if a process exists to load payments made by others on the claim at the claim level, that is a good starting point.

UDS D Records: Financial Report

The receiver reimburses the guaranty funds for their claims, return premium payments and administrative expenses. These requests are transmitted via the UDS D record, which always consists of five rows: a header and trailer row, one row showing all types of payments and recoveries for the most recent quarter, the same information aggregated for the current calendar year, and finally, the same information aggregated for the life of the insolvency.

This is the only UDS record type not related to specific claims. The UDS Financial Manual provides more information.

UDS E Records: Closed Claims

The UDS E record format mirrors the UDS A record, except all reserves are ZERO. The E record is used infrequently because the “cons” of the records often outweigh the “pros”. The pros and cons of producing UDS E records are as follows:

Pros: Facilitates guaranty funds’ requests to re-open claims by giving them accurate information on how claims were set up in the insolvent company’s system. Allows the funds to search the records for names that may need to be corrected in the source, or that may have been set up with inaccurate dates of loss. Having the data included in the UDS E record may thus prevent the fund from getting a response of “not found,” which means a search on a variation of the insured name may have located the claim on the first round.

Cons: Adding tens of thousands of claims to the fund system, when in reality only a few hundred need to be re-opened, takes up system resources, and increases cyber liability exposure in case of a breach.

UDS M Records: Medicare Third-Party Reporting

With a few exceptions, guaranty funds must file Medicare Third-Party Peporting on the same basis as property casualty insurance companies.

Structurally, the UDS M record appears simple. It consists of the first six fields (71 positions) standard to all other UDS records, followed by the same data in the same layout as filed in Medicare Third Party Reporting (Non-Group Health) Claim Input file. This data currently has 112 fields (2,220 positions).

However, preparing UDS M records requires a working knowledge of the principles of Medicare Third-Party Reporting and the insolvent company’s previously reported Claim Input Files over the entire history of the company’s Medicare reporting.

The fundamental principle is to include the claims which meet all of the following criteria:

- Open claim that has been included in an A record.

- At least one claimant on the claim is on Medicare, as confirmed by the insolvent company.

- The insolvent company has previously included the claim as its Ongoing Medical Responsibility (OMR) in a Claim Input File.

- The claim’s OMR has not been terminated by filing an ORM Termination Date and providing the Total Payment Obligation to Claimant (TPOC) amount and date in a subsequent Claim Input File.

Glossary of Terms

Conservatorship

This occurs in some states when more serious financial impairment and supervision is needed, but the company has not yet been determined to be insolvent.

Guaranty Support Inc (GSI)

A for-profit entity established by the National Conference of Insurance Guaranty Funds (NCIGF) as a technology company to serve the insurance insolvency community by assisting receivers and NCIGF members in data collection and transfer and providing additional IT resources as requested.

Insolvent Insurance Company

While technical definitions vary among the laws of the various states, the insurance company’s liabilities are essentially greater than its assets using regulatory insurance accounting principles.

Insurance Regulator

The regulator is typically the state insurance department for the insolvent company’s domiciliary state. The regulator will typically select the receiver and be the ultimate decision maker regarding whether there is supervision, conservatorship, rehabilitation, or liquidation. Note that each status other than supervision requires the court’s approval.

Liquidation

It occurs when a court determines the insurance company is insolvent according to that state’s definition. Usage: The company’s status is often known as “in liquidation, and the court proceeding is known as a “liquidation.”

National Conference of Insurance Guaranty Funds (NCIGF)

A non-profit, voluntary, member-funded association – providing national assistance and support to the property and casualty guaranty funds.

Rehabilitation

This insurance company status indicates more serious financial impairment than Supervision, but where there is a possibility it could be financially improved through a court proceeding and “liquidation avoided.”

Receiver

The generic term for the entity that takes control of a financially troubled insurance company is receiver. The receiver gathers the company’s assets, turns over the loss claims to the state guaranty funds, evaluates creditors’ claims when not covered by the state guaranty funds, collects reinsurance, and distributes the company’s assets as ordered by the court. In a specific proceeding, the receiver may have the title of liquidator, conservator, or rehabilitator.

Run Off Insurance Company

An insurance company which has ceased issuing new policies but is continuing to handle the claims arising under policies issued in the past

State Guaranty Fund

A state-created organization that handles insurance claims made on an insurance company’s policies in liquidation. The liquidation order triggers the state guaranty fund. State guaranty funds exist in every U.S. state, Puerto Rico, and the District of Columbia.

Secure UDS Transfer Facility (SUDS)

The Secure UDS Transfer platform (SUDS) functions as a digital post office, receiving and transferring data files between entities. At the time of liquidation, data flows from the receiver to affected state funds, and this process may continue throughout the insolvency. After one or more months, SUDS will transfer files from the state funds to the receiver.

Supervision

This occurs when an insurance commissioner or department determines that an insurance company is in financial difficulty and finds it necessary to place personnel at the company to approve certain transactions.

Uniform Data Standard (UDS)

Uniform Data Standard. Receivers and state guaranty funds jointly created this set of file formats. Having a common, agreed-upon format is essential to improving data transfer efficiency.

Data Roles & Responsibilities

Company IT Staff

When requested by the receiver, the IT staff of the insolvent company (or a contracted third party) extracts claims data needed by the guaranty funds to handle open claims and claims that may be re-opened claims in the future.

Receiver

The receiver has the legal responsibility to extract the data and convert it to UDS format, but it generally delegates the extraction to the insolvent company’s IT staff and the formatting for UDS to GSI or another IT resource of their choice.

Guaranty Support, Inc. (GSI)

Guaranty Support, Inc. (GSI) is a wholly-owned subsidiary of the National Conference of Insurance Guaranty Funds (NCIGF). GSI maintains the UDS Data Mapper and the Secure UDS Transfer platform on behalf of NCIGF. In addition, GSI provides UDS data expertise, answers questions related to data transfer and works on a contract basis to prepare UDS data when needed.

State Guaranty Funds

Guaranty fund IT staff receive UDS formatted data from the insolvent company (possibly via GSi and/or the SUDS platform), load the data into their system, and commence handling claims.

Software Vendor/IT consultant

In cases where the insolvent insurance carrier’s IT staff is not available to do the work, an outside vendor may be engaged to extract or process data.

Insurance Agent / Broker

Agents and brokers may request general or specific information about claims. The receiver or guaranty fund authorizes the provision of this information.

Managing General Agent (MGA)

Acts on behalf of the insurance company, with authority to issue policies and handle/manage claims. MGAs often represent multiple carriers and can be involved in data extraction and transfer when insolvency occurs.

Third-Party Administrator (TPA)

TPAs handle claims on behalf of the insolvent insurance company and may use the company’s system or handle the claims independently. When claims are on the TPAs system, the TPA functions from a data transition role like the insolvent company.

Frequently Asked Questions

What types of data are most critical for Guaranty Associations?

How should image files be formatted for GA submission?

What is the preferred approach for determining which documents to include?

How should closed claims be handled in UDS Data Mapper?

What should I do if I have questions about specific implementation requirements or technical limitations?

Change Log

10/30/24 – corrected reference for UDS B record transaction code 820 (payment by fund – return premium) to 815 (return premium calculation).

12/17/25 – Added a section for frequently asked questions.

Newsletter signup

Signup for our newsletter to get the latest updates